¶ Reversal Trading

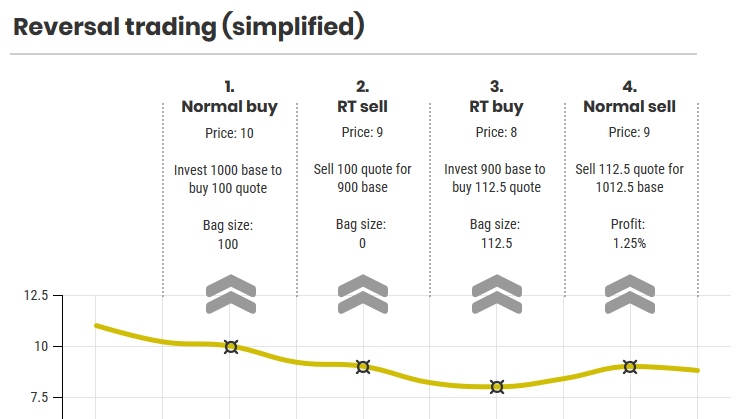

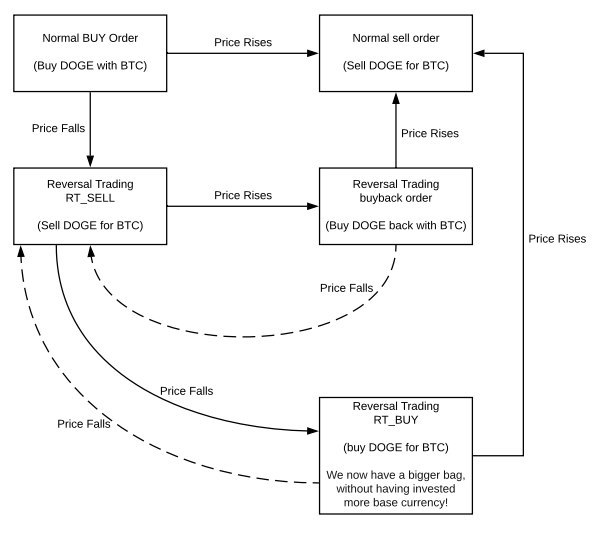

Reversal trading is a technique to keep on trading when prices move against you after an asset has been purchased.

The principle is to use the already invested amount of base currency to accumulate more units of the quote currency while prices are moving against you.

When prices eventually move in your direction again, the -then bigger- bag can be sold for profit at a better price point than without reversal trading.

Trading fees paid while in reversal trading are all accounted for and added to the profit required to sell for a profit.

¶ Visualitation

The example below explains what happens in reversal trading.

There are a few options.

The example below is on a spot exchange trading DOGEBTC.

¶ Option 1

- We buy DOGEBTC (100 coins for 0.1 BTC)

- Price rises and we sell normally (100 coins for 0.12 BTC)

¶ Option 2

- We buy DOGEBTC (100 coins for 0.1 BTC)

- Price drops 10%

- We start Reversal (sell 100 coins for 0.09 BTC)

- Note: Reversal will keep track of average price and calculate % we are down from that price.

- We wait for price to drop further.

- Say price drops another 20% from our average price.

- So now we are a total of 30% down.

- We tell the bot to buy back if we are down 30%

- Now we have 128.5 coins

- Price rises back to our break even point

- We sell with some profit

¶ Properties

- reversal_start_trigger

PAIRSDCA_123DYN

Defines at what % drop from our average price we sell for reversal - reversal_rebuy_drop_trigger

PAIRSDYN

Defines at what % drop from our previous average price we buy back - reversal_rebuy_rise_trigger

PAIRSDYN

Defines at what % from our previous average price we buy back if price rises - reversal_rebuy_timeout

PAIRSDYN

Defines amount of time in minutes to wait before buying back in once we do a reversal sell - reversal_rebuy_expiration

PAIRSDYN

Defines amount of time to wait before releasing the balance reserved by reversal. Prevents a pair from waiting too long for reversal to buy back in.

¶ Examples

market = USDT

DEFAULT_A_buy_strategy = RSI

DEFAULT_A_buy_value = 20

DEFAULT_A_sell_strategy = GAIN

DEFAULT_A_sell_value = 5

# Once we buy a position buy it does not reach our sell target

# Instead of doing a stop_loss we can start a reversal strategy

# If the coin drop to -10 we sell the coin and start a reversal

# Now we wait for the coin to drop to -30% from it's original price to buy back

# It can so happen that instead of dropping further the coin starts rising again

# In this case we buy back in if the coin rises to -2%. Calculated from our original position average price

DEFAULT_reversal_start_trigger = -10

DEFAULT_reversal_rebuy_drop_trigger = -30

DEFAULT_reversal_rebuy_rise_trigger = -2

RSI_candle_period = 3600

RSI_length = 14